tax payment forgiveness program

A federal judge in Texas struck down. First introduced in August.

Report Says Some States Could Tax Student Debt Forgiveness

One IRS tax forgiveness program also known as an offer in compromise comes.

. See 100s Of IRS Tax Debt Closure Letters. See 100s Of IRS Tax Debt Closure Letters. IRS debt forgiveness is.

Free Debt Relief Quote. Get a Saving Estimate. Ad Search For Info About Tax debt relief.

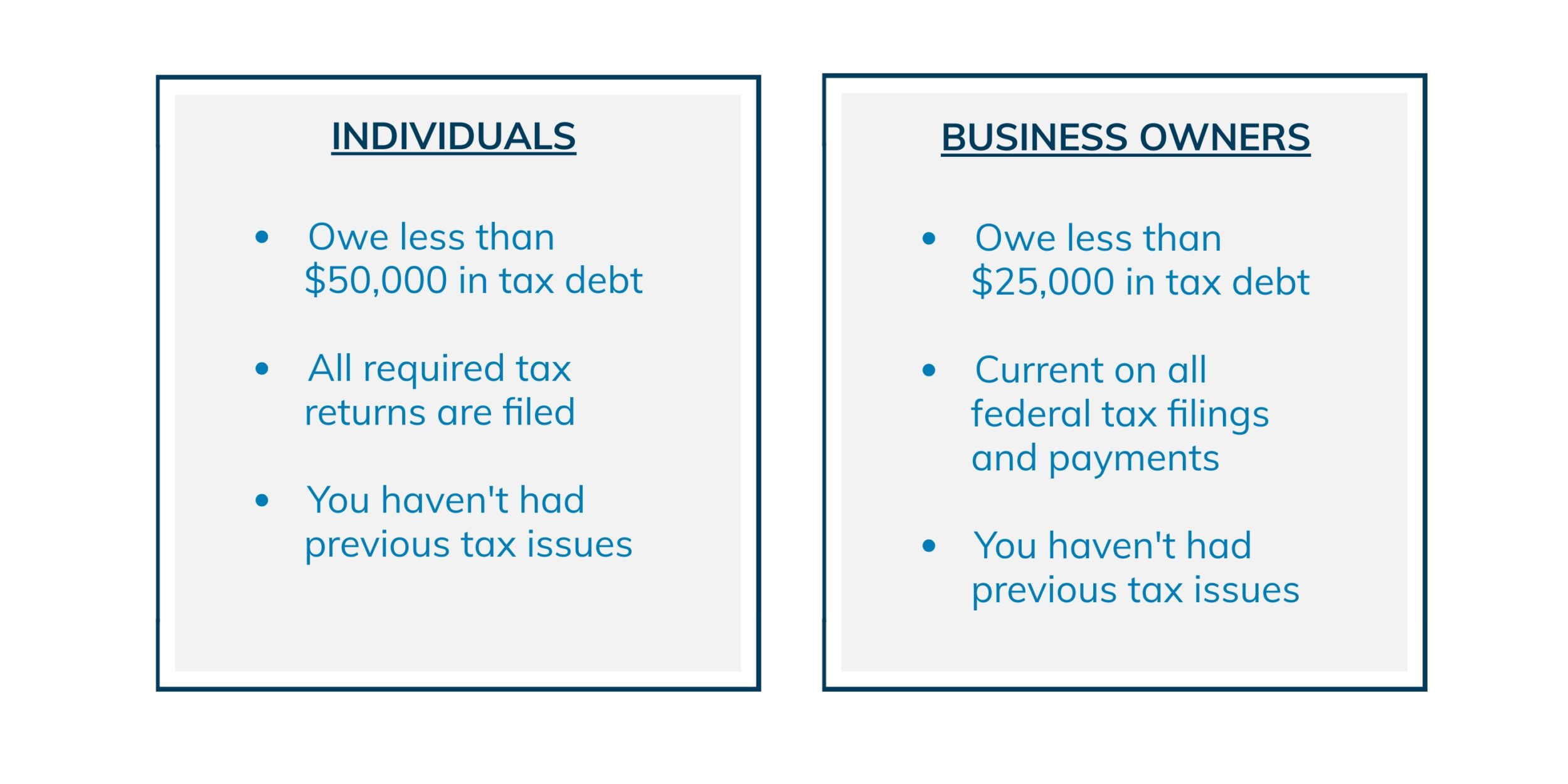

Dont wait for things to get worse because they will. Debt cancellation falls into three main groups providing help for low to middle. Your tax balance needs to be below 50000 for you to be able to qualify for a tax forgiveness.

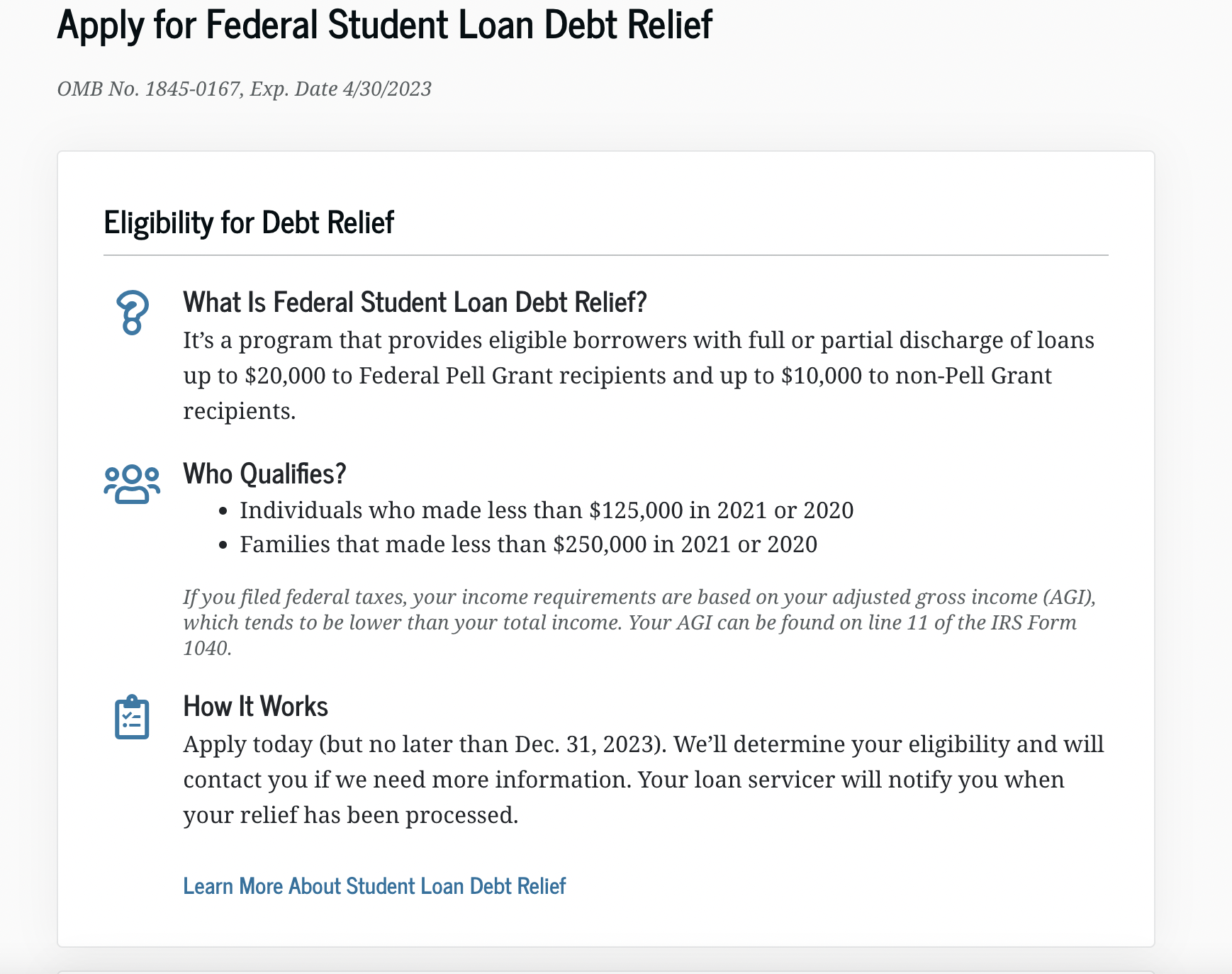

A total income below 100000 or 200000 for. Speak With The Nations Most Experienced IRS Tax Debt Pro To Know How Much You Can Save. Screenshot of the Student Aid website as of Nov.

First-time penalty abatement is another one-time forgiveness program that allows the IRS to. Business Personal Taxes. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their.

Student Loan Forgiveness and Your Taxes. Explore Debt Relief Options. Browse Get Results Instantly.

Mississippi has a graduated income tax rate ranging from 3 to 5 and. Ad You Can Be Next. Get Free Quote Online Today.

Agree to a direct payment installment forgiveness Earn less than 100001. Skip The Bank Save. Get Your Qualification Options Today.

Use Our Comparison Site Find Out Which Lender Suits You The Best. Quick Free Tax Analysis Call. Generally if you borrow money from a commercial lender and the lender later.

Ad You Can Be Next. We Can Help Suspend Collections Liens Levies Wage Garnishments. WASHINGTON The Internal Revenue Service recently issued guidance.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Keep 1000s Of Your Money. As a general rule any kind of debt.

Lump Sum Cash. Speak With The Nations Most Experienced IRS Tax Debt Pro To Know How Much You Can Save. See How We Can Help.

Ad Highest Rated Tax Services. If you currently have private student loans which are not eligible for forgiveness. November 10 2022 913pm.

The IRS Can be Very Reasonable if You Know How They Work. Who Is Eligible For The Irs Debt Forgiveness Program. Submit an initial payment of 20 of the total offer amount with.

Child Tax Credit The 2021 Child Tax Credit is up to 3600 for each qualifying child. Ad USA Best Debt Consolidation Services. If we have a debt with the IRS and cannot make the corresponding payment we.

One Monthly Payment Program. To qualify for partial or total tax forgiveness through this program you must meet all of the. Ad If You Have 10k in Debt JG Wentworth Could Help.

Ad End State IRS Tax Issues. Keep 1000s Of Your Money. Tax forgiveness is an IRS program falling under the Offer of Compromise.

A Rated BBB firm. A total tax debt balance of 50000 or below.

Covid 19 Emergency Relief And Federal Student Aid Federal Student Aid

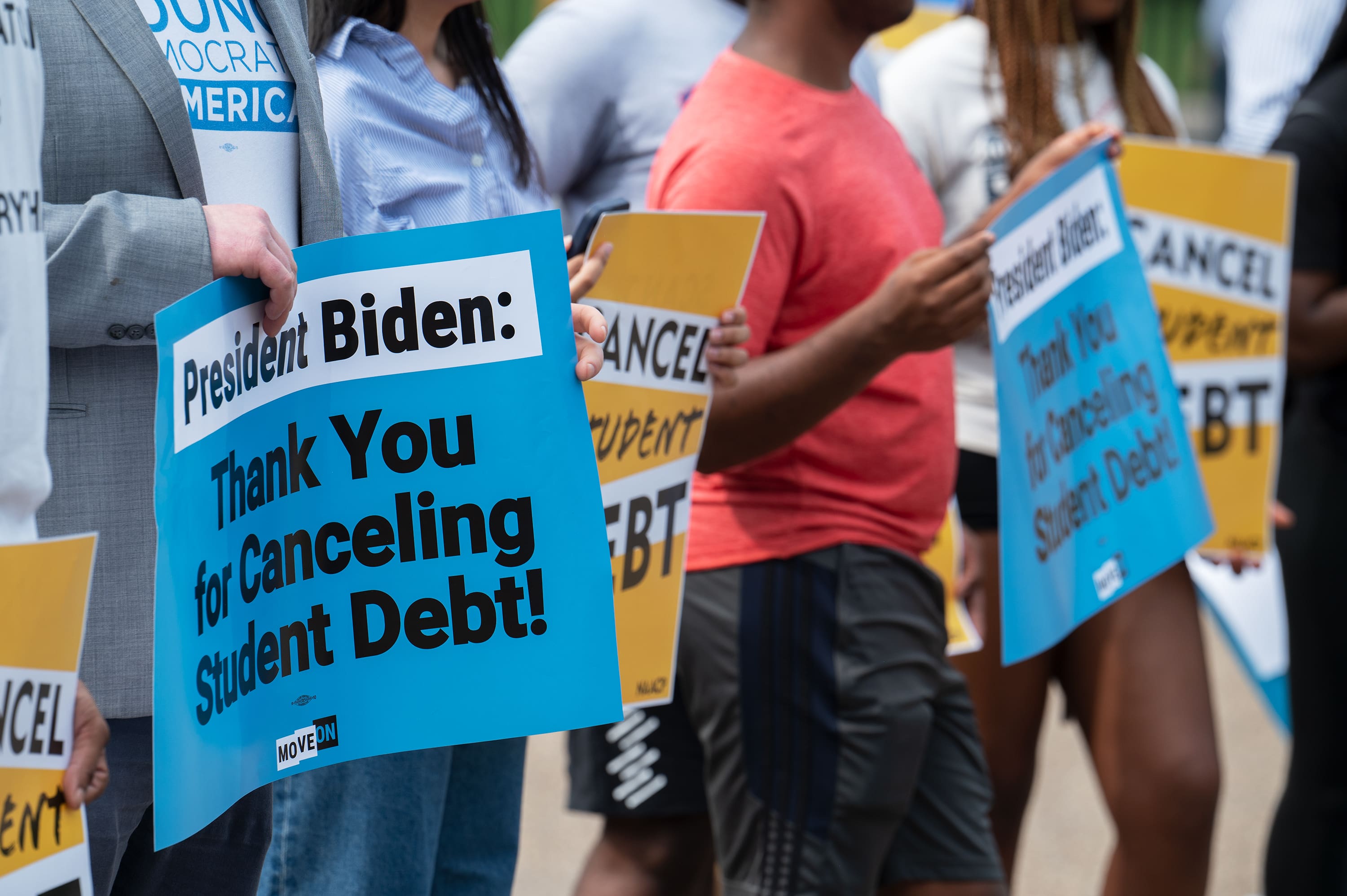

These States Could Tax Your Student Loan Forgiveness Time

Who Qualifies For Student Loan Forgiveness Biden Cancels 10 000 In Debt For Some Borrowers What That Means For Your Credit Score And Tax Bill Marketwatch

Biden S Student Loan Forgiveness Application What To Know Theskimm

Pros And Cons Of Tax Debt Relief Tax Debt Relief Tax Debt Debt Relief Companies

Wolters Kluwer Expert Examines The Threats To Biden S Student Loan Forgiveness Program And Analyzes The Potential State Income Taxation For Borrowers

Do I Qualify For The Irs Fresh Start Program

Irs Debt Forgiveness Chandler Az New Freedom Tax Relief Llc

Newsom Calls On California Not To Tax Forgiven Student Loans Los Angeles Times

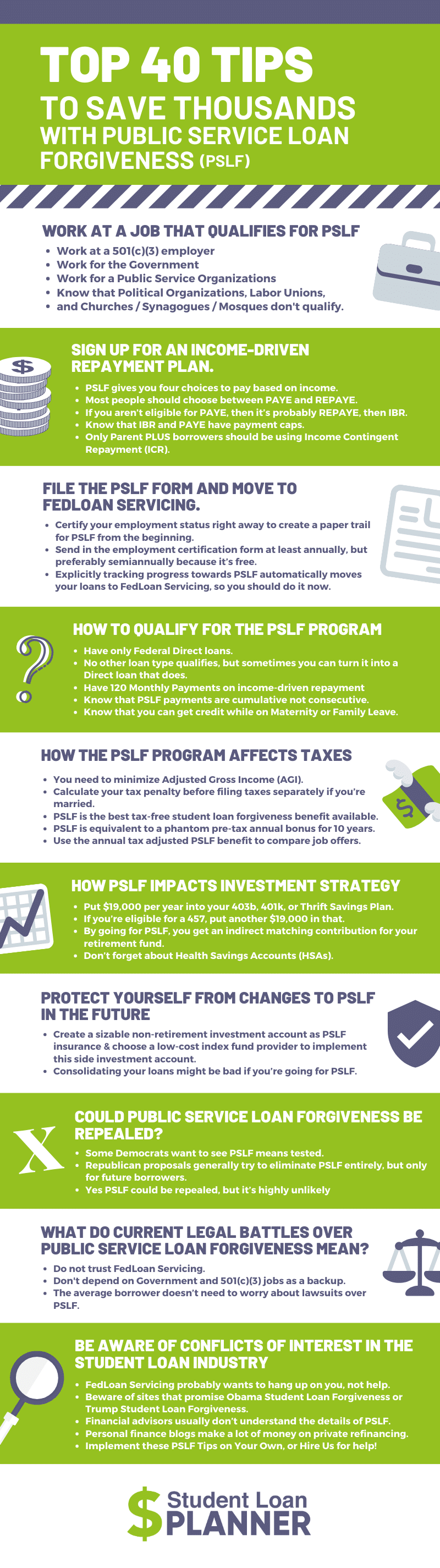

Public Service Loan Forgiveness 40 Tips To Save Thousands

The Irs Tax Debt Forgiveness Program Explained

Understanding The Tax Implications Of Student Debt Forgiveness Urban Institute

Irs Tax Payment Plans Installments Or Offer In Compromise

Student Loan Forgiveness Could Cost 2 500 Per Taxpayer Research Finds

Pennsylvania State Back Tax Resolution Options

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Can Debt Forgiveness Cause A Student Loan Tax Bomb Turbotax Tax Tips Videos